free cash flow yield s&p 500

See Figure 1 in the full version of our report for the chart of FCF Yield for the SP 500. 5 rows ETFs Tracking The SP 500 Dividend and Free Cash Flow Yield Index ETF Fund Flow.

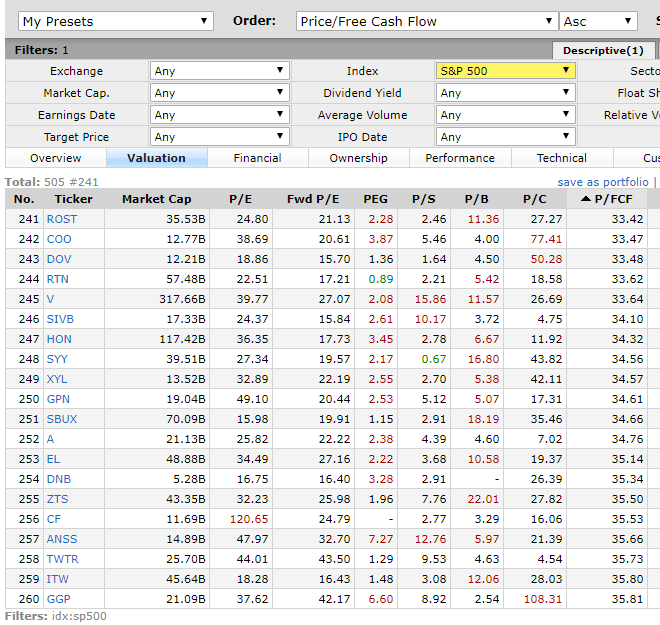

The S P 500 Median Price To Free Cash Flow Ratio Is Now 34 66 Seeking Alpha

This metric can be valuable to look at when comparing different companies in a similar industry or sector.

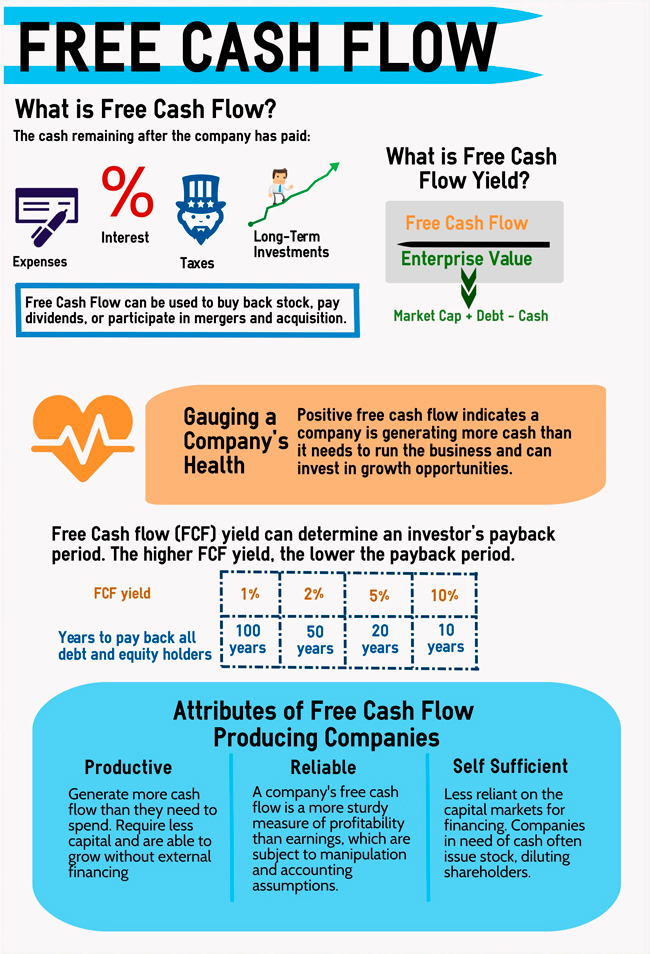

. The ratio is calculated by taking. This report analyzes free cash flow FCF enterprise value and the trailing FCF yield for the SP 500 and each of its sectors. Free cash flow yield is really just the companys free cash flow divided by its market value.

Universe index are removed from the SP 500 Dividend and Free Cash Flow Yield Index simultaneously while universe drops will be removed from the SP Emerging Markets Dividend and Free Cash Flow Yield Index and SP Developed Ex-US. SP 500s current Price to Cash flow ratio has increased due to shareprice growth of 017 from beginning of the first quarter and due to cash flow for the trailig twelve month period contraction of -9745 sequential to Pcf of 1403 from average the Price to Cash flow ratio in the forth quarter of 123210. Dividend and Free Cash Flow Yield Index at the following semi-annual rebalancing.

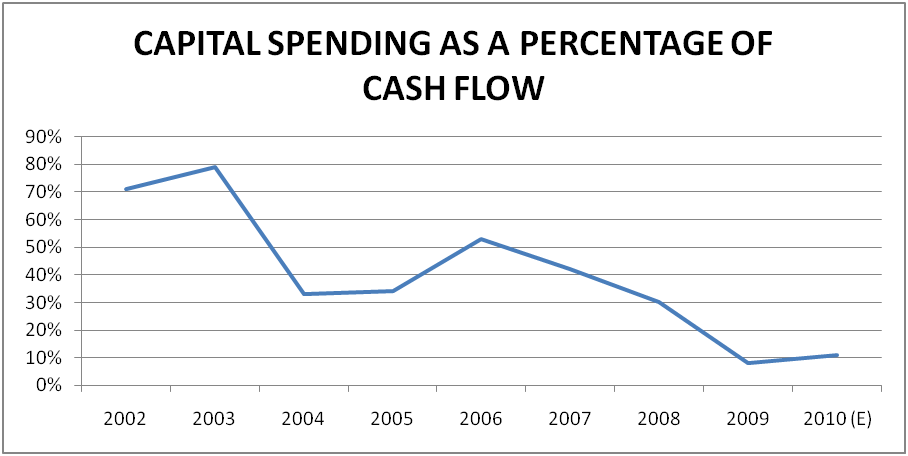

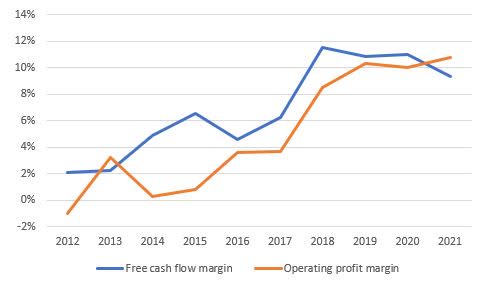

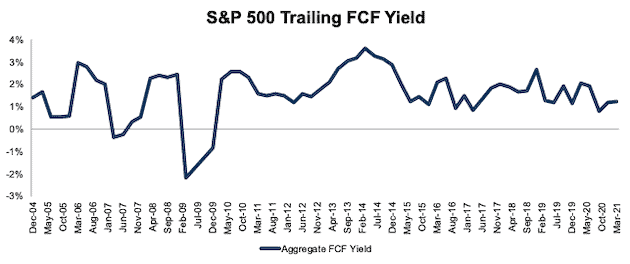

To break it down free cash flow yield is determined first by using a companys cash flow statement Cash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period subtracting capital expenditures from all cash flow. Around 25 of the time it has been below 36 and. The trailing FCF yield for the SP 500 rose from 11 on 33121 to 22 as of 31122.

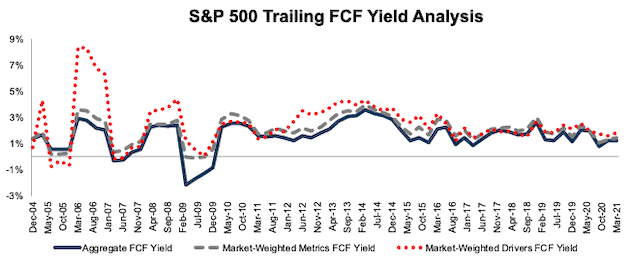

The SP 500 Dividend and Free Cash Flow Yield Index is designed to measure the constituents of the SP 500 that exhibit both high dividend yield and sustainable dividend distribution characteristics while maintaining diversified sector exposure. The trailing FCF yield for the SP 500 rose from 11 at the end of 2020 to 16 as of 51921 the earliest date 2021 Q1 data was provided by all SP 500 companies. Historically the equity market free cash yield on trailing free cash flow has averaged around 45.

This metric is valuble when analyzing the amount of cash flow available in comparion to the total market value. The trailing FCF yield for the SP 500 fell from 2 at the end of 2019 to 12 as of 32321 the earliest date 2020 annual data was provided by all SP 500 companies. 2 months 3 months 6 months 9 months 1 year 2 years 5 years 10 years Max.

Called the free cash flow yield this gives investors another way to assess the value of a company that is comparable to the PE ratio. For more information on how our historical price data is adjusted see the Stock Price Adjustment Guide. FCF yield for the SP 500 fell from 19 at the end of 2019 to 11 through 111720 the earliest date updated 10-Qs for the SP.

Dont let this fool you though. Free Cash Flow growth YY Annual Comment. The Healthcare Industrials Energy Telecom Services Utilities.

Historical price to free cash flow ratio values for SP Global SPGI since 2010. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. Its less than its highs but this doesnt mean the markets expensive.

Daily chart sp 500 dividend and free cash flow yield index Duration. The valuations of the years 2007 through 2011 were the exception not the norm. From 1978 to 2018 the average FCF yield of the SP 500 was 485.

Date Stock Price TTM FCF per Share Price to FCF Ratio. Sequentially TTM Free Cash Flow grew by 158. The free cash flow yield is the total free cash flow market capitalization.

The trailing FCF yield for the SP 500 rose from 08 in 2Q20 to 19 as of 81821. FCF yield for the SP 500 fell from 18 at the end of 2019 to 08 through 2Q20 or its lowest level since December 2009. TTM FCF Yield for the SP 500 From December.

Only two SP 500 sectors saw an increase in FCF yield since the end of 2019 as well show below. Only free cash flow yield is in a far lower historical percentile 52nd for the entire SP 500 and 47th for the median stock in the index the report said. On the trailing twelve months basis SP 500 faced contraction in cumulative twelve months Free Cash Flow by -356 in 1 Q 2022 year on year.

154 Best Buy BBY 11493 has gotten off to a strong start in 2021 up roughly 15 for the year to date several percentage points more than. Before the pandemic the FCF yield for the SP 500 was 20 on 33120. Only sector leaders exhibiting both high dividend yield and free cash flow yield are included in the index.

Cash flows rose faster than stock prices as the indexs free cash flow FCF yield rose to its highest level since 123118. Free cash flow yield. SP 500 FCF Yield Falls to Lowest Level Since December 2009.

The recently launched SP 500 Dividend and Free Cash Flow Yield Index combines dividend yield and free cash flow yield in the constituent selection process. As of March 11 the markets free cash flow yield is about 54. SP 500 Trailing Free Cash Flow Yield Free cash flows can be expressed as a valuation measure in the form of a free cash yield when they are divided by price.

Compare SPGI With Other Stocks S. Only three SP 500 sectors saw an increase in trailing FCF yield YoY based on 2020 financial data as well show below.

The Power Of Free Cash Flow Yield Pacer Etfs

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

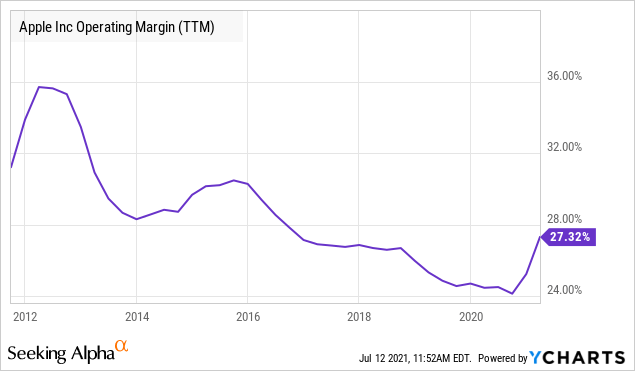

Apple Stock Are Free Cash Flows Or Dividends The Allure For Investors Nasdaq Aapl Seeking Alpha

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow And Dividends How A Focus On Yield Can Help Investors Provide For Today And Prepare For Tomorrow Library Insights Manning Napier

Google A Free Cash Flow Analysis Nasdaq Goog Seeking Alpha

S P 500 Sectors Free Cash Flow Yield Through 4q20 New Constructs

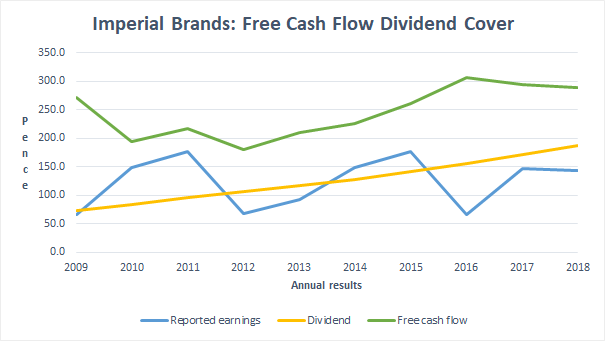

Why Dividend Investors Should Look At Free Cash Flow Seeking Alpha

Free Cash Flow And Dividends How A Focus On Yield Can Help Investors Provide For Today And Prepare For Tomorrow Library Insights Manning Napier

The S P 500 Median Price To Free Cash Flow Ratio Is Now 34 66 Seeking Alpha

Sony Stock Free Cash Flow Yield Stacking Up Well Versus Big Tech Names Otcmkts Snejf Seeking Alpha

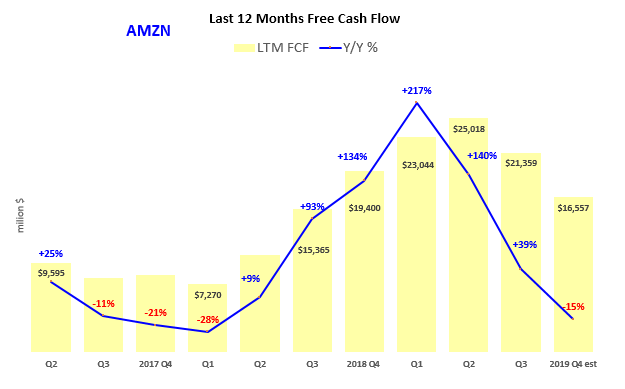

Amazon Stock And Free Cash Flow Benefit In The Long Run From Its Huge Spending Nasdaq Amzn Seeking Alpha

Top Sector Etf For 2021 Free Cash Flow Ring Nasdaq Ring Seeking Alpha

Price To Free Cash Flow Backtest Fat Pitch Financials

Google A Free Cash Flow Analysis Nasdaq Goog Seeking Alpha

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

S P 500 Sectors Free Cash Flow Yield Through 4q20 New Constructs